Requirements For Apple Credit Card. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Your information lives on your iphone, beautifully laid out and easy to understand. Citizen or a lawful u.s. You must be at least 18 years or older, depending on where you live. Here's apple's list of requirements: Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Be 18 years or older, depending on where you live. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. With apple card, we completely reinvented the credit card. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. What are the apple credit card requirements? Such a wide range is a promising indicator that apple is willing to approve those. To get apple card, you must meet these requirements:

Requirements For Apple Credit Card . Through This Credit Card, Apple Could Learn What It Takes To Manage A Card Network.

Apple Warns Against Storing The Apple Card In Leather And Denim Techcrunch. Such a wide range is a promising indicator that apple is willing to approve those. You must be at least 18 years or older, depending on where you live. What are the apple credit card requirements? Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. With apple card, we completely reinvented the credit card. To get apple card, you must meet these requirements: Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Here's apple's list of requirements: Citizen or a lawful u.s. Your information lives on your iphone, beautifully laid out and easy to understand. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Be 18 years or older, depending on where you live. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and.

The new apple credit card is issued by goldman sachs and will run on the mastercard network.

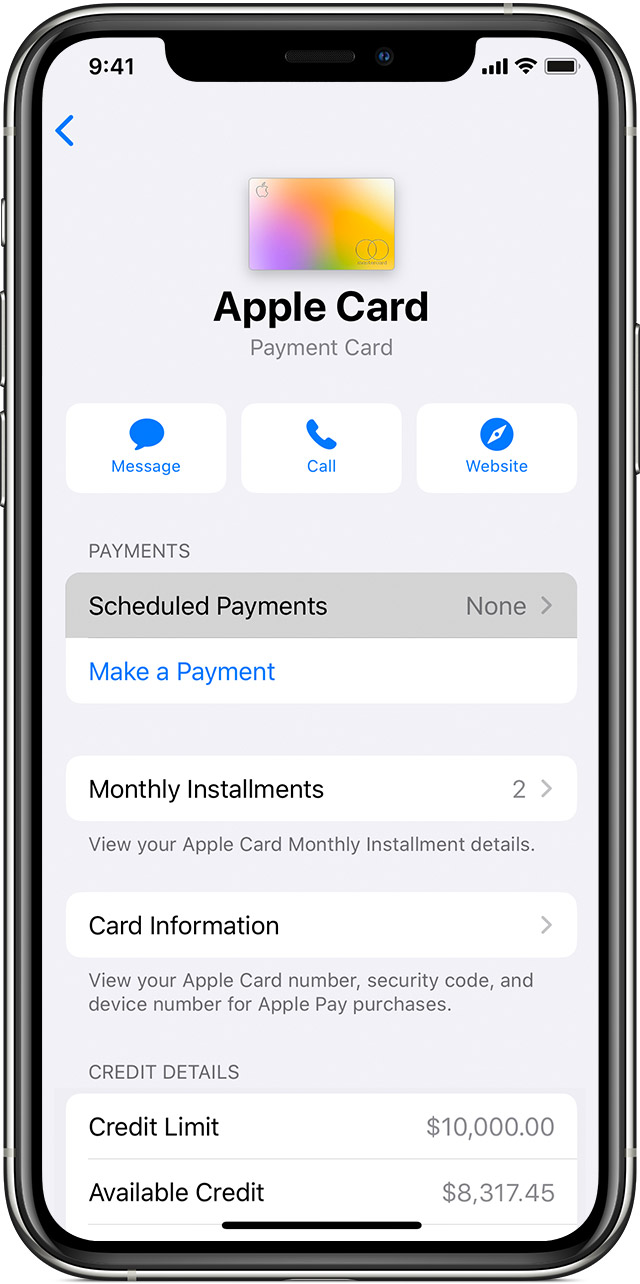

Excellent falling within this credit range does not guarantee approval by the issuer. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. For example, increasing your credit limit could improve your buying power and your credit score. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Apple's new credit card could arrive in the uk as soon as autumn, a top expert has predicted. Interest rates and interest charges. The apple card is a credit card, plain and simple, but instead of being a physical card it exists in digital form within the wallet app on your iphone. Your apple card limit is the maximum amount that you can spend using your card before you need to pay off some of your balance. With apple card, we completely reinvented the credit card. How can you use this news to make you money and should you use the apple credit. Apple has introduced apple card, a credit card by apple for apple pay customers, made in collaboration with goldman sachs and mastercard. Excellent falling within this credit range does not guarantee approval by the issuer. The apple credit card* offers a tasty rewards plan, particularly for those who can use apple pay for most of their purchases. In terms of cash back potential, it's most. Apple card is now publicly live for anyone with an update iphone (requires iphone 6 or later). Yes, you can create or use an apple id without a credit card or other payment method. The apple card can be a smart choice if you're building or rebuilding your credit, because its benefits. Through this credit card, apple could learn what it takes to manage a card network. Aim to pay your credit card statement in full, even if you qualify for the apple card's best terms. Here's what it's like to use it, how its rewards work, and how to apply. The card runs entirely through apple pay, and i'm update 8/20/19: It's not a good idea to carry a balance on a card with a. You can skip the credit card requirement if you go into the app store first and select a free app to download before you create an account. Be 18 years or older, depending on where you live. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. Issued in partnership with goldman sachs on the mastercard network, the card earns a crisp 3% cash back on purchases at apple and other select vendors, 2% cash back on. The apple credit card apparently approves even those with terrible credit. To handle those 3 percent, 2 percent, and 1 percent while we don't know what credit scores will be required to get this card, apple indicated it will be working closely with goldman sachs to make it. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Apple card is a new branded credit card for iphone ($899 at amazon) users. To get apple card, you must meet these requirements:

Apple Announces Apple Card A Credit Card Built Into Apple Wallet : Apple Card Is A Credit Card Created By Apple Inc.

Apple Card Faq Interest Rates Rewards Sign Up And Everything Else You Need To Know Macworld. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Such a wide range is a promising indicator that apple is willing to approve those. Here's apple's list of requirements: Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. With apple card, we completely reinvented the credit card. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. What are the apple credit card requirements? You must be at least 18 years or older, depending on where you live. Be 18 years or older, depending on where you live. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Citizen or a lawful u.s. To get apple card, you must meet these requirements: Your information lives on your iphone, beautifully laid out and easy to understand.

Apple Will Manage 10 Of Global Credit Card Transactions By 2025 Analyst Says : We Eliminated Fees And Built Tools To Help You Pay Less Interest.1 Advanced Technologies Like Face Id, Touch Id, And Apple Pay Give You A New Level Of.

Introducing Apple Card A New Kind Of Credit Card Created By Apple Apple. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. With apple card, we completely reinvented the credit card. Such a wide range is a promising indicator that apple is willing to approve those. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. Your information lives on your iphone, beautifully laid out and easy to understand. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. You must be at least 18 years or older, depending on where you live. Be 18 years or older, depending on where you live. Citizen or a lawful u.s.

Apple Card A Surprisingly Great Card But Who Needs It By Michael Beausoleil The Startup Medium , The apple card offers generous rewards to people buying its products and using its technology but has weaknesses as an everyday credit card.

Wow The Apple Credit Card Is Popular One Mile At A Time. Your information lives on your iphone, beautifully laid out and easy to understand. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. To get apple card, you must meet these requirements: Citizen or a lawful u.s. You must be at least 18 years or older, depending on where you live. Here's apple's list of requirements: Be 18 years or older, depending on where you live. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. With apple card, we completely reinvented the credit card. Such a wide range is a promising indicator that apple is willing to approve those. What are the apple credit card requirements? Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest.

Apple Card Can Be Damaged By Wallets And Jeans Bbc News - You Must Be At Least 18 Years Or Older, Depending On Where You Live.

Apple Card My First Day With Apple S New Credit Card Zdnet. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Such a wide range is a promising indicator that apple is willing to approve those. To get apple card, you must meet these requirements: With apple card, we completely reinvented the credit card. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. You must be at least 18 years or older, depending on where you live. What are the apple credit card requirements? Citizen or a lawful u.s. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Be 18 years or older, depending on where you live. Your information lives on your iphone, beautifully laid out and easy to understand. Here's apple's list of requirements:

Set Up Apple Pay In Wallet On Iphone Apple Support - Apple Card Offers An Apr Between 13.24% And 24.24% Based On Your Credit Score, And All Approved Cardholders Will Be Placed At The Bottom Of The Interest Tier They Fall Into, Which Will Save Everyone A Little Bit Of Interest.

Apple Credit Card Archives Sglifestyle Sg. With apple card, we completely reinvented the credit card. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. To get apple card, you must meet these requirements: Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Your information lives on your iphone, beautifully laid out and easy to understand. Such a wide range is a promising indicator that apple is willing to approve those. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. What are the apple credit card requirements? Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Citizen or a lawful u.s. Be 18 years or older, depending on where you live. Here's apple's list of requirements: You must be at least 18 years or older, depending on where you live.

Apple Details Why Some Apple Card Applicants Might Get Declined Macrumors , If You Want To Earn The Alliant Cashback Visa® Signature Credit Card (2.5% Cash Back On All Purchases, Up To $250 In Cash Back Rewards Per Billing Cycle) Or Citi® Double.

How To Sign Up For And Use Your Apple Card Pcmag. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. Your information lives on your iphone, beautifully laid out and easy to understand. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Citizen or a lawful u.s. Be 18 years or older, depending on where you live. You must be at least 18 years or older, depending on where you live. Such a wide range is a promising indicator that apple is willing to approve those. With apple card, we completely reinvented the credit card. To get apple card, you must meet these requirements: Here's apple's list of requirements: Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. What are the apple credit card requirements? Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app.

Apple Warns Against Storing The Apple Card In Leather And Denim Techcrunch : Through This Credit Card, Apple Could Learn What It Takes To Manage A Card Network.

Apple Card Makes Credit Cool Naysayers Doubt The Success Of The By Julian Vel Onezero. Be 18 years or older, depending on where you live. Your information lives on your iphone, beautifully laid out and easy to understand. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. With apple card, we completely reinvented the credit card. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Here's apple's list of requirements: You must be at least 18 years or older, depending on where you live. Such a wide range is a promising indicator that apple is willing to approve those. Citizen or a lawful u.s. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. To get apple card, you must meet these requirements: What are the apple credit card requirements? Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions.

Apple Card My First Day With Apple S New Credit Card Zdnet . Interest Rates And Interest Charges.

Apple Will Reportedly Launch A Credit Card With Goldman Sachs The Verge. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Here's apple's list of requirements: Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. With apple card, we completely reinvented the credit card. Such a wide range is a promising indicator that apple is willing to approve those. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. What are the apple credit card requirements? Citizen or a lawful u.s. Be 18 years or older, depending on where you live. You must be at least 18 years or older, depending on where you live. Your information lives on your iphone, beautifully laid out and easy to understand. To get apple card, you must meet these requirements:

Everything We Know About Apple Card Updated X2 Computerworld . And Issued By Goldman Sachs, Designed Primarily To Be Used With Apple Pay On Apple Devices Such As An Iphone, Ipad, Apple Watch, Or Mac.

Apple Card Can Be Damaged By Wallets And Jeans Bbc News. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Such a wide range is a promising indicator that apple is willing to approve those. To get apple card, you must meet these requirements: Your information lives on your iphone, beautifully laid out and easy to understand. Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. Citizen or a lawful u.s. Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. With apple card, we completely reinvented the credit card. Here's apple's list of requirements: Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Be 18 years or older, depending on where you live. What are the apple credit card requirements? We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. You must be at least 18 years or older, depending on where you live. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and.

Report Apple Working On Zero Interest Installment Plan For Ipad Mac . Applicants Are Prompted To Input Basic Information Including Credit Score Requirements.

Apple Card What To Know Issued By Goldman Sachs No Fees. Your information lives on your iphone, beautifully laid out and easy to understand. With apple card, we completely reinvented the credit card. Be 18 years or older, depending on where you live. Citizen or a lawful u.s. Residential address that isn't a if you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for apple card. Ultimately, the apple card is best for people who are excited about using mobile wallets and who already make a lot of purchases with apple and. We eliminated fees and built tools to help you pay less interest.1 advanced technologies like face id, touch id, and apple pay give you a new level of. To get apple card, you must meet these requirements: Apple in august 2019 released the apple card, a credit card that's linked to apple pay and built right into the wallet app. What are the apple credit card requirements? Apple is partnering with goldman sachs for the card, which is optimized for apple pay but will still works like a traditional credit card for all of your transactions. You must be at least 18 years or older, depending on where you live. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. Such a wide range is a promising indicator that apple is willing to approve those. Here's apple's list of requirements: